Under the holding company structure, Nichirei Group’s operating companies engage in a wide range of businesses, including processed foods, marine, meat and poultry products, temperature-controlled logistics, and biosciences. In pursuit of sustainable growth and the enhancement of corporate value over the medium to long term, the Company’s Board of Directors formulates Group strategies and supervises the business execution of operating companies.

The holding company adheres to the principles of the Corporate Governance Code and views the achievement of fair and transparent management as an important management issue. Accordingly, under the supervision of the Board of Directors, we will continue to strengthen governance by promoting appropriate resource allocation, speeding up decision-making and ensuring thorough compliance.

In addition, we have established ourselves as a company with an Audit & Supervisory Board system, an institutional design specified in the Companies Act of Japan.

■Corporate Governance Structure (As of June 25, 2024)

■Activities Aimed at Strengthening the Nichirei Group’s Corporate Governance Structure

| Composition | 11 directors (5 outside directors) |

|---|---|

| Number of meetings in FY2025 |

20 |

| Description of operations |

Promotes proper allocation of Group resources, swift decision-making and thorough compliance through supervision of the Group’s strategy planning and business execution of operating companies. After discussion by the Group Strategy Committee, which meets twice a year, the Board of Directors formulates and approves the Group’s strategies and conducts quarterly checks of the status of implementation at each Group business. It also engages in highly effective supervision of executive directors and executive officers. |

In pursuit of sustainable growth and enhancement of corporate value over the medium to long term, the Company’s Board of Directors formulates the Group’s strategies and supervises the execution of business at operating companies. Specific matters discussed during FY2024 were as follows. Additionally, the details of discussions on underlined items is included.

| Management Strategies | Revision of the Nichirei Group’s material matters (materiality), review of target values/KPIs, and issues to be addressed in order to achieve them |

|---|---|

| Financial Strategy | Measures for shareholder returns |

| Medium-term Business Plan | Progress of Medium-term Business Plan Compass Rose 2024 and issues to be addressed |

| Sustainability | The Nichirei Group’s 2050 Carbon Neutral Declaration and revision/expansion of CO₂ emission reduction targets, Group human resources strategy, development of globally capable human resources, ESG Index evaluation and challenges |

| Governance | Activities of the Nominating Advisory Committee and Remuneration Advisory Committee, and review of the Nichirei Group Global Governance Basic Rules |

| Business Strategies | Management strategy issues in significant domestic and overseas investment projects, the status of resource allocation by overseas region, and related issues |

| Agenda Items | Details of Discussions |

|---|---|

| Shareholder Return Measures | Finance explained the status of review of shareholder return measures (including past performance trends, comparison with other companies, and dividend simulations). Measures for increasing shareholder value, as well as dividend levels and shareholder composition were also discussed. |

| Development of Globally Capable Human Resources | Human Resources explained the status of review of the development of Nichirei Group human resources for overseas (including the required number of personnel by 2030, talent requirements, development initiatives, and development schedules). Discussions were also held regarding plans and methods for recruiting overseas human resources (including locally), methods for selecting development candidates, the number of candidates to be developed, and effective development methods, as well as the living arrangements during overseas assignments and career development after returning from overseas assignments. |

| Review of the Nichirei Group Global Governance Basic Rules | Legal explained the status of the review of Group policies, Group regulations, and the Nichirei Group Global Governance Basic Rules. Discussions were also held on the optimal structure for implementing the Global Governance Basic Rules in overseas group companies, the measures for disseminating and monitoring Group policies and the Global Governance Basic Rules after the structure review, and the education system for employees dispatched from Japan. |

| Composition | 5 Audit & Supervisory Board members (3 outside Audit & Supervisory Board members) |

|---|---|

| Number of meetings in FY2025 |

16 |

| Description of operations |

As a body that is independent from the Board of Directors, the Audit & Supervisory Board communicates with directors, the corporate internal audit departments and other departments of the holding company in accordance with the annual audit policy and audit plan to gather information and prepare the audit environment. |

| Committee | Role | Chairperson | Number of Meetings in FY2025 |

|---|---|---|---|

| Nominating Advisory Committee |

Discusses the suitability of candidates for senior management and directors/Audit & Supervisory Board members, as well as successor plans, and reports its findings to the Board of Directors. | Itsuo Hama Outside Director |

8 |

| Remuneration Advisory Committee |

Discusses the remuneration system, remuneration levels, the appropriateness of remuneration amounts, and other related matters, and reports to the Board of Directors. | Kenji Hamashima Outside Director |

7 |

The Board of Directors comprises up to 11 members, appointed to one-year terms in order to enhance flexibility in response to changes in business conditions. Resolutions to appoint directors must be approved by a majority of shareholders, with at least one third of those shareholders who have voting rights in attendance. To improve transparency and strengthen supervisory functions, five of the current 11 directors are outside directors. The Board meets at least once a month. The Board of Directors is chaired by the Representative Director and Chairman, who also serves as an executive officer. Together, the Representative Director and Chairman and the Representative Director and President oversee the Group’s overall execution of business.

Nichirei has adopted the audit & supervisory board member system. Of the five audit & supervisory board members, three are outside audit & supervisory board members, of whom one has experience at a financial institution, another is an experienced attorney, and the third has worked at a government agency. Audit & Supervisory Board meets once a month, in principle, convening additional meetings as necessary. Nichirei has established a framework to enhance the supervisory functions of audit & supervisory board members, allowing for the effective use of audit & supervisory board members, and strengthening the supervisory role of management.

The Company adheres to its Criteria for Independence when appointing outside directors and outside audit & supervisory board members designated by the Company as independent directors/audit & supervisory board members. A vested interest in Nichirei is denied outside directors and their close relatives, as well as outside audit & supervisory board members and any companies or organizations of which they are directors or that they serve in other important positions.

The Nichirei Group believes that in order for the Board of Directors to effectively fulfill its roles and responsibilities, it must be composed of both inside and outside members with sufficient knowledge and experience in fields related to business management. We have designated the following knowledge and experience as important from a corporate management perspective. In addition to having appropriate experience in all of the following areas, the Company selects director candidates based on the areas in which the Company has particular expectations.

| Corporate Management | Demonstrated leadership in corporate management as a top executive; management experience at a listed company with diverse stakeholders |

|---|---|

| ESG/Sustainability | Experience and expertise in promoting ESG initiatives; knowledge of and experience in making value judgments about ESG and social significance and sustainability for companies; knowledge and experience in promoting corporate sustainability; experience and expertise in human resource development related to continuously developing diverse human resources |

| Global | Cross-cultural communication skills and a high level of ability to get things done in overseas business as well as knowledge and expertise about markets, economies and business in specific countries and regions gained through experience including the management of local subsidiaries |

| Research and Development | Experience and expertise in research and development to establish a medium- to long-term competitive advantage |

| Marketing | Experience and expertise in sales and marketing |

| Human Resources Strategy | Experience and expertise in human resource development and strategy to continuously secure and develop diverse talent |

| DX | Experience, including management experience, and expertise in DX and IT-related fields |

| Corporate Management | Demonstrated leadership in corporate management as a top executive; management experience at a listed company with diverse stakeholders |

|---|---|

| Financial Accounting/Finance | Expertise in financial accounting related to financial reporting and auditing; experience and expertise in corporate financing and management |

| Legal Affairs/Compliance | Experience and expertise in legal compliance, regulatory compliance, internal controls, and promotion of norms and corporate behavior required by society; experience in the legal profession; expertise and network related to quality assurance |

| Corporate Management |

ESG/ Sustainability |

Global | Research & Development | Marketing | Human Resources Strategy | DX | Financial Accounting/ Finance |

Legal Affairs/ Compliance |

||

|---|---|---|---|---|---|---|---|---|---|---|

| Directors |  |

● | ● | ● | ● | ● | ● | |||

|

● (Processed foods) |

● | ● | ● | ||||||

|

● (Marine, meat and poultry products) |

● | ● | |||||||

|

● | ● | ● | ● | ● | ● | ||||

|

● | ● | ● | ● | ● | |||||

|

● (Logistics) |

● | ● | ● | ||||||

|

● | ● | ● | ● | ||||||

|

● | ● | ● | ● | ● | ● | ||||

|

● | ● | ● | ● | ||||||

|

● | ● | ● | ● | ||||||

|

● | ● | ● | ● | ||||||

| Audit & Supervisory Board Members |

|

● | ● | |||||||

|

● | ● | ● | |||||||

|

● | ● | ||||||||

|

● | ● | ● | |||||||

|

● | ● | ||||||||

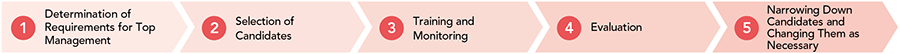

The Company positions the succession plan for the Group’s senior management, including the president, as one of its most important issues and pursues it from a medium- to long-term perspective based on the corporate management philosophy. Specifically, the Nominating Advisory Committee, which is chaired by an outside director, carries out training, monitoring, and selection of successor candidates according to the selection process, and reports its findings to the Board of Directors based on thorough discussions. Based on the Nominating Advisory Committee’s report, the Board of Directors approves and adopts the proposed new structure for the Group’s senior management.

●Image of the Succession Plan

Design of the remuneration scheme for directors and executive officers incorporates the opinions of a third-party organization. Remuneration comprises a base remuneration component and a bonus component. Base remuneration is paid at a fixed rate determined in accordance with a remuneration schedule. Bonuses are paid according to the concept of productivity-linked bonuses, based on the results of the Nichirei Group, the performance-budget achievement rate of the relevant officer’s business area, and an individual qualitative assessment. Outside directors receive base remuneration only; they are not paid a bonus. Nichirei has established a Remuneration Advisory Committee which meets, in principle, once a year to deliberate on such topics as the remuneration system, remuneration levels, and the validity of remuneration, before reporting its findings to the Board of Directors. The committee comprises the Representative Director and President, a audit & supervisory board member, and outside directors. Officer remuneration is determined by the Board of Directors. The total amount of remuneration and bonuses paid to directors must be within the limit resolved at a General Meeting of Shareholders.

The policy for determining individual director remuneration is for the Remuneration Advisory Committee to discuss the appropriateness of each director’s remuneration each fiscal year and for the decision to be made by the Board of Directors. In these discussions, the Remuneration Advisory Committee reflects changes in the management environment and the opinions of shareholders and investors, and obtains information necessary for discussion from third-party agencies with extensive global knowledge and experience.

Following the deliberations of the Remuneration Advisory Committee during the current fiscal year, the Board of Directors has determined that the current remuneration system for directors (and other officers) is generally appropriate. On the other hand, expectations for role of outside directors have increased in recent years, and we need to acquire capable outside human resources with diverse backgrounds. In response to the need, we have changed the remuneration market survey data we refer to when determining the remuneration levels of outside directors from “remuneration levels of companies similar in business type and size to ours” to “remuneration levels of companies similar in size to ours (all industries).” In addition, “Chairperson’s allowance” is added when an outside director assumes the position of the chairperson of the Nomination Advisory Committee or the Remuneration Advisory Committee. There are no other significant changes to the policy for determining directors (and other officers) remuneration for FY2025.

| Directors (Excluding Outside Directors) |

|

|---|---|

| Outside Directors |

|

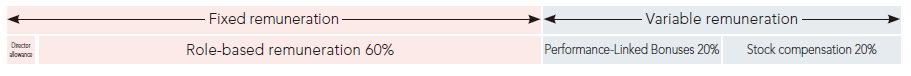

Basic (fixed) remuneration consists of role-based remuneration and a director allowance, and variable remuneration consists of performance-linked bonuses and stock compensation. Remuneration levels are set at appropriate amounts with reference to objective compensation market survey data (compensation levels of companies competing with the Group in terms of business and human resources, including those in the food and logistics industries), taking into consideration the responsibilities and number of directors, changes in the business environment going forward, and the opinions of third-party organizations.

●Guideline for the Ratio of Remuneration for Directors Excluding Outside Directors

| Remuneration Composition | Purpose/Description |

|---|---|

| Role-based Remuneration | Base remuneration for performance of duties Set according to the significance of the role of each director |

| Director Allowance | Remuneration for the responsibilities of making and supervising the execution of management decisions Set at a uniform amount for all directors |

| Performance-linked Bonuses | Remuneration to motivate directors to achieve annual financial and strategic goals The amount paid when achieving goals (“standard amount”) is set as a percentage of rolebased compensation Paid within a range of 0-200% of the standard amount according to degree of achievement |

| Stock Compensation (Restricted Shares) | Remuneration to encourage management from a long-term/Group-wide perspective and the perspective of shareholders and investors Value of shares issued each fiscal year (“standard amount”) is set as a percentage of rolebased compensation Restricted shares are issued annually in an amount equal to the standard amount, and restrictions are lifted upon a director’s retirement |

Outside directors shall be paid only a base remuneration (fixed remuneration). Base remuneration consists of “Basic remuneration,” which is paid in a uniform amount to all outside directors as a members of the Board of Directors, and “Chairperson’s allowance,” which is additionally paid to the chairperson of the Nominating Advisory Committee or the Compensation Advisory Committee. The level of remuneration shall be set at an appropriate amount, taking into consideration the time and effort spent by each outside director to fulfill their expected roles and functions, as well as objective remuneration market survey data (remuneration levels of companies similar in size to ours (all industries).

The amount to be paid to each individual as a performance-linked bonus varies within a range of 0% to 200% of the base amount for each position, depending on the achievement of Company-wide, business and individual performance targets.

Amount of individual bonus = Base amount by position × Performance evaluation coefficient (0–200%)

The performance evaluation coefficient is a weighted average of the evaluation coefficients of each key performance indicator (KPI).

| Performance Indicators (KPI) | Reasons for selection | Evaluation Weight | ||

|---|---|---|---|---|

| Representative director | Director (In charge of Function) |

Director (In charge of Business) |

||

| Company-wide performance evaluation | 100% | 70% | 60% | |

| Net sales | Expansion of size of Company | 10% | 5% | 10% |

| EBITDA | Improvement of ability to generate cash and profitability of core businesses | 40% | 30% | 20% |

| Profit | Improvement of shareholder returns | 10% | 5% | 10% |

| ROIC | Optimization of business portfolio and improvement of capital efficiency | 20% | 15% | 10% |

| ESG third-party evaluation* | Strengthen response to sustainability related issues | 20% | 15% | 10% |

| Business performance evaluation | - | - | 30% | |

| Net sales | Expansion of size of Company | - | - | 5% |

| EBITDA | Improvement of ability to generate cash and profitability of core businesses | - | - | 15% |

| ROIC | Optimization of business portfolio and improvement of capital efficiency | - | - | 10% |

| Individual performance evaluation | - | 30% | 10% | |

| Responding to medium- and long-term strategic issues and initiatives, including ESG | - | 30% | 10% | |

| Total | 100% | 100% | 100% | |

| ESG Third-party Assessments | Reason for Selection |

|---|---|

|

|

In order to ensure the appropriateness and objectivity of the matters related to remuneration for individual directors, the Board of Directors shall make decisions on such matters after deliberations and reports by the Remuneration Advisory Committee, which is comprised mainly of independent outside directors. In its deliberations, the Remuneration Advisory Committee shall take into account changes in the management environment and the opinions of shareholders and investors, and shall properly obtain information necessary for its deliberations from an objective and professional standpoint.

In the process of determining the performance-linked bonuses to be paid to each individual, the individual performance targets and evaluations shall be drafted by the representative director and president, who is delegated by the Board of Directors, after interviewing each director, and shall be decided by the representative director and president after deliberation by the Remuneration Advisory Committee. The determined individual performance targets and evaluation results shall be reported to the Board of Directors in a timely and appropriate manner to ensure the objectivity and fairness of the evaluation. The final bonuses to be paid to each individual shall be drafted by the representative director and president, and decided by the Board of Directors after deliberation by the Remuneration Advisory Committee.

The details of officer remuneration for FY2024 are presented in the 106th Annual Securities Report.

In the event of a deterioration in the Company’s business performance, or in the event of quality problems, serious accidents, or scandals that damage the Company’s corporate value or brand value, the Company may reduce or deny the remuneration, etc., to directors.

With respect to the performance-linked bonuses, when factors that should be taken into account as temporary special factors that were not assumed when the targets were set at the beginning of the fiscal year arise, performance may be evaluated after eliminating the effects of such factors, and the bonuses paid to each individual director may be calculated.

With respect to the performance-linked bonuses, in the event that a director violates the law or his/her duty of care or fidelity as a director before the bonus is paid, or in the event that such a violation is discovered within 2 years after the bonus was paid, or in the event of other similar events, the director’s right to receive the bonus, who related to such violation, shall be extinguished, and the Company may request to return the bonus actually paid.

Remuneration for executive officers who do not concurrently serve as directors shall be determined in accordance with the Company’s policy for determining such remuneration for directors.

| Classification | Total amount of remuneration by type (Millions of Yen) | Total amount of remuneration (Millions of yen) |

Number of executives (persons) |

||

|---|---|---|---|---|---|

| Base remuneration | Performance-linked bonuses | Restricted stock compensation | |||

| Directors (excluding outside directors) | 118 (218) |

36 (69) |

69 (69) |

224 (358) |

7 (7) |

| Outside directors | 48 | ー | ー | 48 | 4 |

| Audit & Supervisory Board members (excluding outside Audit & Supervisory Board members) | 48 | ー | ー | 48 | 2 |

| Outside Audit & Supervisory Board members | 32 | ー | ー | 32 | 3 |

| Total | 246 (346) |

36 (69) |

69 (69) |

353 (486) |

16 (16) |

| Classification | Date of resolution at the General Shareholders Meeting | Base remuneration | Performance-linked bonuses | Restricted stock | Number of executives (persons) |

|

|---|---|---|---|---|---|---|

| Director | June 25, 2024 (The 106th Ordinary General Shareholders Meeting) | Up to ¥270 million (including Outside directors: up to ¥100 million) | Up to ¥130 million | Up to ¥100 million | Up to 70,000 shares | 11 (including Outside directors: 4) |

| Audit & Supervisory Board members | June 26, 2012 (The 94th Ordinary General Shareholders Meeting) | Up to ¥120 million | - | - | 5 (including Outside Audit & Supervisory Board members: 3) | |

As necessary, and with the assistance of outside experts, the Company conducts analyses and evaluations of the Board of Directors’ activities to ensure its decision-making is effective. Summaries of the results are subsequently disclosed.

| Evaluation Procedure | Subjects: Directors and Audit & Supervisory Board members (15 individuals in total) Period: January–February 2024 Methods: A self-assessment involving third-party engagement, where questionnaires and individual interviews are conducted by external experts. In addition to the annual questionnaire, individual interviews are conducted on a three-year cycle. |

|---|---|

| Summary of the Evaluation Results for FY2024 | Summarizing the results of the questionnaire and opinions of the directors interviewed, in addition to the free and open exchange of frank opinions in an atmosphere conducive to discussion, there have been improvements in Board of Directors meeting materials, and discussions in the Nominating Advisory Committee and Remuneration Advisory Committee are being shared to some extent with the Board of Directors. As a result of the continuous implementation of such efforts to enhance discussions at Board of Directors meetings, in line with previous evaluations of the Board’s effectiveness, many respondents expressed the positive opinion that the effectiveness of the Company’s Board of Directors has been secured to a considerable degree. Furthermore, directors and Audit & Supervisory Board members pointed out multiple potential areas for improvement in order to further enhance the Board’s effectiveness. These matters are expected to be reviewed in future deliberations of the Board of Directors. Taking the evaluation by the third-party experts to heart, the Board of Directors discussed the points raised or suggested, and has decided to reflect them in its operations as follows. |

| Evaluation and Opinion | Numerous respondents felt that there is currently not enough time for discussions of the Group’s long-term strategies and that more time should be allocated for this purpose. In response to questions about the Group’s risk tolerance and preparedness, there were opinions pointing out that concrete measures to deal with these matters are an issue to be addressed going forward, as well as numerous negative evaluations on the five-point scale of the questionnaire, suggesting that many directors and Audit & Supervisory Board members feel that discussions on risk management have been insufficient. |

|---|---|

| Future Approach |

The Board of Directors has decided to take the following measures to secure more opportunities and time at its meetings to discuss long-term strategies and risks. 1) Cooperation with other advisory bodies and committees of the Board of Directors In order to formulate medium- to long-term management strategies for the entire Group, the Board has decided to deepen cooperation with the Group Strategy Committee, which discusses medium- to long-term strategies, and with the Group Risk Management Committee, which deliberates on risks that could impair corporate value. 2) More efficient operation of Board of Directors meetings i. Further reduction of time spent explaining proposals and other matters ii. Further review of Board of Directors meeting materials iii. Review of matters submitted for discussion at Board of Directors meetings |

| Evaluation and Opinion | In light of Corporate Governance Code Principle 4.8 and social trends such as the increasing number of institutional investors who demand that outside directors constitute a majority of the Board, many respondents felt that the appropriate ratio of outside directors will continue to be an issue for ongoing study, and that the number of outside directors should be increased. On the other hand, there were also respondents who felt that the opinions of inside directors, who possess a deep understanding of the Company’s business, are crucial. Therefore, even if the proportion of outside directors is increased, it is important to maintain a balance with the proportion of inside directors. In addition, numerous respondents felt that although the Company has made relatively good progress in appointing women directors and Audit & Supervisory Board members and that there is no need for urgent measures, women have never been appointed as inside directors or Audit & Supervisory Board members, and therefore it is necessary to expedite the training and promotion of women candidates for these positions. |

|---|---|

| Future Approach | At the Annual General Shareholders Meeting held on June 25, 2024, the Company proposed an increase in the number of outside directors by one, and 11 directors, including five outside directors (including three women), were elected. In addition, the Company has set a ratio of 30% for women employees in management positions at the holding company as a KPI for “securing and developing a diverse array of human resources,” which is a material matter it has identified for achieving the Nichirei Group’s long-term management goals toward 2030. With the aim of appointing women inside directors and securing diversity, the Company is steadily promoting women to management positions as a pool of candidates (the ratio of women employees in management positions in FY2024 was 17%). On April 1, 2024, the Company also established a Diversity Promotion Division, which is advancing initiatives under the leadership of the Company’s first woman executive officer, appointed on the same day. |

Nichirei Integrated Report 2023>Evaluations of Effectiveness

Nichirei Integrated Report 2022>Evaluations of Effectiveness

Nichirei Integrated Report 2021>Evaluations of Effectiveness

Nichirei Integrated Report 2020>Evaluations of Effectiveness

Nichirei distributes materials for use at Board of Directors meetings to each director and Audit & Supervisory Board member at least three days in advance of meetings in order to ensure meaningful discussions.

When internal communication and coordination are required to accurately provide Company information in response to instructions from independent outside directors or independent outside Audit & Supervisory Board members, the secretary in charge acts as the contact point in order to ensure necessary coordination with relevant departments.

Newly appointed directors and Audit & Supervisory Board members are given training as necessary on the Companies Act and other related laws, management strategy, financial analysis and other such matters. Additional training on legislative revisions and management issues is provided as necessary after new members assume office. Moreover, explanations of the Group’s businesses and tours of the major facilities are provided to outside officers as necessary.

Cross-shareholdings are only utilized when it is determined that they will contribute to improving the Company’s corporate value: for example, by maintaining and strengthening trade and cooperative relationships. In addition, every year the Board of Directors reviews the economic rationale of individual shareholdings of this type from a medium- to long-term perspective. If the importance of a particular shareholding is determined to have diminished, the shares are sold. In conducting such reviews, the Board of Directors carefully examines and makes a comprehensive judgment on whether the benefits, such as profits from transactions, and dividends or risks are commensurate with the cost of capital, followed by consideration of a qualitative evaluation of the strategic importance of the shareholding.

In regard to the exercise of voting rights for cross-shareholdings, the Company will review all the details of the relevant proposals in the investee company’s shareholders meeting agenda, and if any of the following apply to the investee company, the Company will make a decision after careful examination on a case-by-case basis:

(1) The investee has engaged in acts that will lead to a loss of shareholder value

(2) The investee’s performance or stock price has deteriorated significantly

(3) There are other serious doubts with respect to agreeing to the proposal